Top HVAC distribution industry trends to use to your advantage in 2026

**Last Updated October 29, 2025

Editor's Note:

This article has been fully update for 2026 to capture the latest market forces, technologies, and sales strategies transforming the HVAC industry.

HVAC Trends for 2026

As the HVAC industry moves toward 2026, distributors, contractors, and manufacturers are navigating one of the most transformative periods in recent history. From stricter refrigerant regulations to smarter systems powered by AI, these changes are reshaping how businesses operate — and how customers expect to be served.

Let’s explore the key HVAC trends in 2026 that will define the year ahead, including regulatory shifts, technological innovation, market competition, reactivating dormant customers, workforce dynamics and more.

Refrigerant Regulations: The Low-GWP Phaseout

Beginning January 1, 2026, it will be illegal to install new refrigeration systems using high Global Warming Potential (GWP) refrigerants, such as legacy hydrofluorocarbons (HFCs). This phaseout, driven by EPA SNAP rules and international climate goals, is accelerating demand for low-GWP refrigerant systems and technicians trained to handle them.

Distributors should expect increased requests for compliant systems, retrofit kits, and technician training resources. Those who stay ahead of the regulatory curve can position themselves as trusted partners during this transition.

Electrification and the Rise of Heat Pumps

Government incentives for all-electric systems continue to expand, reshaping customer preferences and inventory needs. Heat pumps — once seen as a niche solution — are now mainstream thanks to their energy efficiency, comfort, and lower environmental impact.

Expect to see growing adoption of hybrid and variable refrigerant flow (VRF) systems, as well as geothermal heat pumps in new builds. For distributors, stocking the right mix of all-electric inventory will be key to meeting market demand and maintaining competitiveness.

Smarter Systems Powered by AI

Artificial intelligence and IoT integration are revolutionizing HVAC system performance. AI-enabled controls and predictive maintenance tools are becoming standard across residential and commercial sectors, enabling real-time diagnostics, efficiency optimization, and automated fault detection.

As smart systems evolve, your customer experience should too — not just for comfort, but for visibility, control, and proactive sales. Distributors and contractors who embrace connected technologies can enhance customer relationships through ongoing data-driven support.

Indoor Air Quality (IAQ) Takes Center Stage

The global focus on health and building performance continues to drive IAQ innovation. New codes and standards are pushing for higher filtration (MERV 13+), UV-C sterilization, and energy recovery ventilators (ERV/HRV).

Demand for IAQ products is growing across residential, commercial, and educational facilities — making it a major revenue driver for 2026. IAQ conversations are now part of nearly every HVAC sale, signaling a shift from luxury to necessity.

Supply Chain Delays and the Planning Imperative

Even as global supply chains recover, component shortages and shipping delays continue to disrupt project timelines. Distributors who excel in planning, forecasting, and proactive communication will be best positioned to maintain customer trust.

Visibility into inventory and strong relationships with manufacturers are essential for staying competitive. Expect more distributors to leverage digital tools that provide real-time supply insights and automated order updates.

Technician Shortages and Workflow Simplification

The technician shortage — now exceeding 100,000 unfilled positions nationwide — remains one of the industry’s most pressing challenges. With many senior technicians nearing retirement and fewer new entrants joining the trade, efficiency and workflow automation are paramount.

To stay ahead, distributors are simplifying processes and using technology to support contractors: faster quoting, centralized records, and proactive notifications are no longer optional — they’re essential to keeping work moving.

Sustainability, Innovation, and Competitive Shifts

The North American residential HVAC market is becoming a proving ground for innovation and strategic expansion. Companies are differentiating through:

- Sustainable materials and low-GWP refrigerants

- IoT-enabled systems with smart diagnostics

- Strategic acquisitions to expand portfolios

- Enhanced after-sales service and customer engagement

These shifts underscore a competitive landscape where innovation, adaptability, and ethical marketing drive long-term growth.

The Marketing Trends Heating Up in 2026

Just as the technology evolves, so does HVAC marketing. Four major marketing trends are set to dominate in 2026:

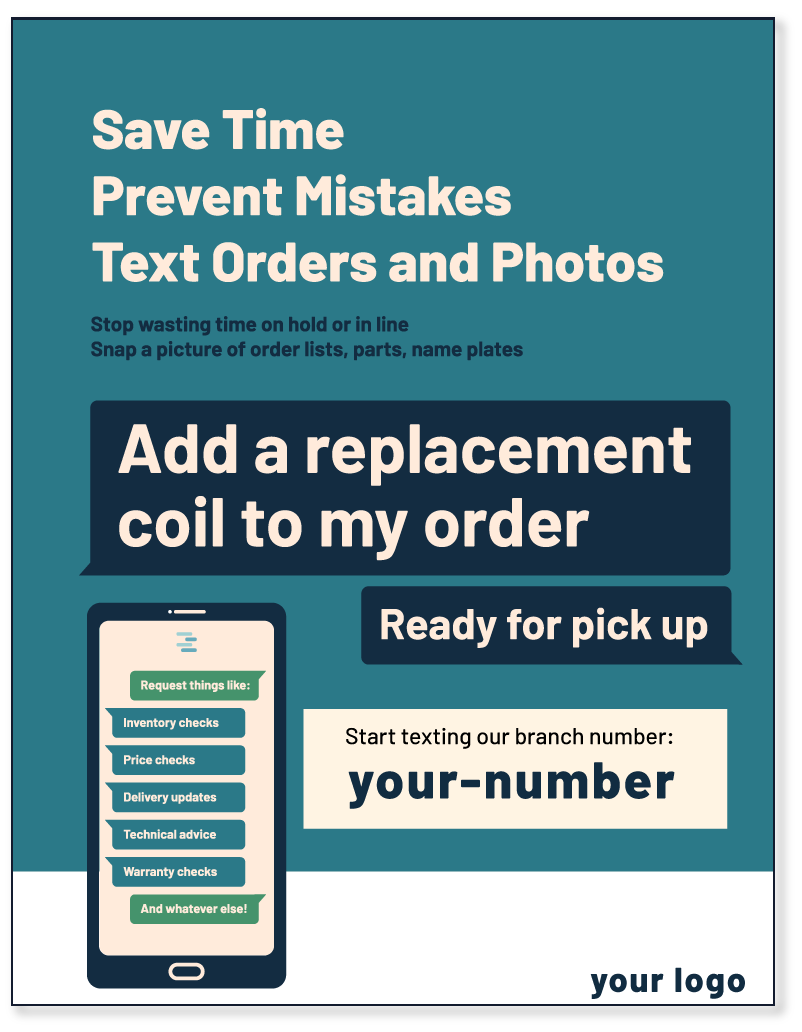

- SMS marketing: Customers expect fast, direct communication. SMS marketing lets you send mass promotions, confirm orders, and follow up on service, delivering higher open and response rates than email.

- Proactive Outreach Over Reactive Sales: Waiting for inbound calls is giving way to strategic, outbound communication. Businesses are reaching out first with personalized messages, quote reminders, and product recommendations that turn dormant accounts into repeat buyers.

- Centralized Customer Data for Smarter Targeting: Marketing success now depends on visibility across every customer interaction. Centralized data allows teams to see purchase patterns, track engagement, and tailor messages based on real customer behavior.

- Multi-Channel Consistency: Customers want to do business through text, email, web chat, and social — and they expect a seamless experience wherever that is. Marketing strategies in 2026 are aligning these channels for streamlined customer service.

- Growing Wallet Share: Instead of chasing new leads, HVAC businesses are focusing on keeping existing customers engaged and reactivating dormant ones through personalized, proactive selling.

Fuel Every Opportunity with the Order Engine

As refrigerant regulations tighten, systems get smarter, and project timelines shrink, HVAC distributors can’t rely on manual workflows anymore. Every branch has that one standout rep — the “Jeff” of the team — who always seems to know exactly when a customer’s ready to order. Jeff’s quick, proactive, and tuned in to every detail. He doesn’t just take orders — he creates them.

The challenge? Most teams don’t have a system that helps everyone work like Jeff. Without full visibility into customer messages, quotes, and orders, it’s nearly impossible to move fast or sell proactively. That’s where Prokeep's Order Engine changes the game.

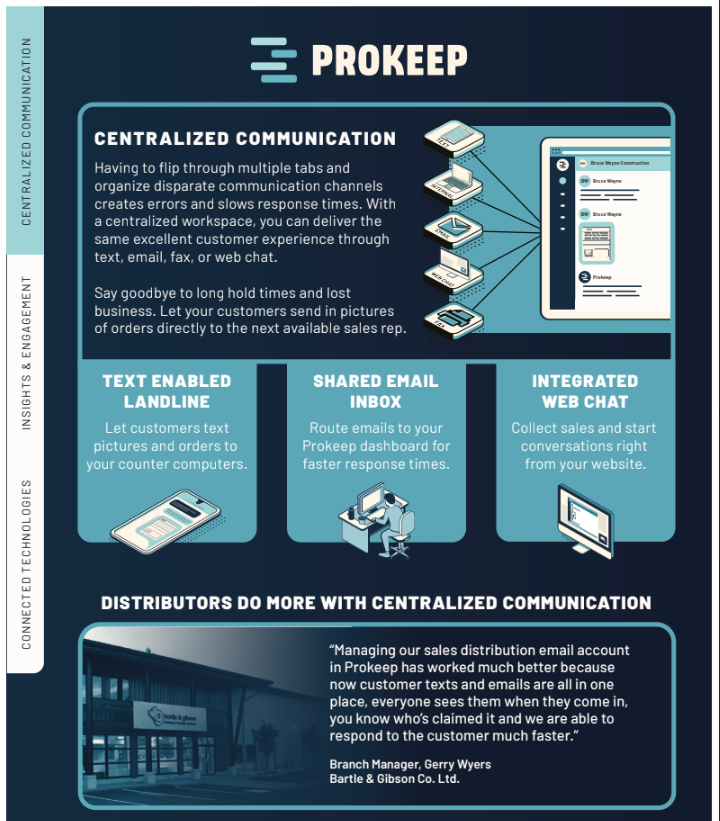

Here's how it powers growth: - Serve Customers Faster: Reply to every customer faster — whether they text, email, or chat — from a single shared workspace.

- Centralize Customer Records: Connect every quote, order, and conversation so nothing slips through the cracks.

- Drive More Orders: Turn insights into action with real-time data that helps you follow up on quotes, re-engage inactive accounts, and launch promotions at the right moment.

Looking Ahead: Turning Change into Opportunity

From regulatory compliance to digital transformation, the challenges ahead are also opportunities. Businesses that adapt — investing in training, technology, and transparent customer relationships — will emerge stronger.

The 2026 HVAC landscape rewards those who move proactively rather than reactively. Whether it’s stocking compliant refrigerants, embracing smart systems, or doubling down on IAQ expertise, now’s the time to act.

* The following information from 2023 may no longer be advantageous, but has become table stakes for most HVAC/R Distributors

As the HVAC industry moves forward, business owners everywhere face steady and unexpected changes. For HVAC distributors, these trends could be difficult or advantageous, depending on whether you modify your operations with them in mind.

We compiled some of the most pressing innovations of 2023 that, with utilization, will make your business stand out amongst competitors.

Sustainable HVAC

With growing global temperatures, there is an increasing need for efficiency in HVAC equipment. Businesses that invest in sustainable, systematic parts will see a greater return on their investment, putting them ahead of competitors.

Changes in demands for HVAC distributors

Following a greater need for efficiency in HVAC equipment The U.S. Department of Energy (DOE) raised the lowest efficiency standards for air-source heat pumps and central air conditioners in the new year.

Since January 1st, 2023, all equipment available must meet the minimum Seasonal Energy Efficiency Ratio (SEER) standard: 14 for those in the northern states and 15 for those in the southern states, up from 13 previously.

Rising energy prices

Due to global supply disruptions and rising demand, energy prices will continue to rise steadily into 2023. For HVAC contractors this means that utilizing efficient equipment will create a greater return on investment for both them and their customers.

New refrigerants distributors should take advantage of

R-410a or hydrofluorocarbon (HFC) refrigerants have been commonly used by HVAC technicians since 2010. These systems have a high potential for dangerous leaks that create pollutants.

As a result, manufacturers will need to build revamped heat pumps and air conditioning units compatible with R-454b and the U.S. Environmental Protection Agency will phase out its importation by 85 percent over the next 15 years.

Distributors aware of these changes and who are quick to offer innovative solutions that meet the efficiency requirements will not only aid the HVAC industry in transitioning to more sustainable practices but will stay ahead of competitors and remain the first choice for their customers.

Better HVAC employment opportunities and market growth

With more extreme weather comes a greater need for heating and cooling. The HVAC industry has seen consistent growth throughout previous years, which is predicted to persist through 2023. By 2014, growth is expected to reach 13.6%.

The US HVAC systems market size was valued at $16.54 billion in 2021 and is projected to grow at a compound annual growth rate (CAGR) of 5.6% until 2030. Between 2010 and 2019, HVAC unemployment dipped from 10.5% to 8%, and employment growth is continuing to increase by 8% until 2030.

This growing demand will mean more opportunities for contractors, which in turn creates a greater demand for HVAC distributors who will supply their business. As the HVAC industry grows distributors will need to be readily prepared to meet this demand.

More technicians are utilizing mobile communication

The greater demand for HVAC services creates a heavier workload for technicians, many of which are turning to quicker means of communication in order to work faster. With a heavier workload, more technicians are looking to do business instantly without interrupting their workflow.

In order to accommodate this new need, distributors are turning to tools like Prokeep to serve customers faster, centralize records and drive more orders. Prokeep connects every conversation and order in one place so every rep can respond faster, sell proactively, and win more orders.

New HVAC technology

As the demand for HVAC in 2023 grows, technicians and distributors are incorporating technology to optimize their workflow and eliminate human errors. With technology tools designed for HVAC business owners can manage their inventory, customer data, and automate routine processes so they happen instantly.

Tools that distributors should be incorporating into their workflow in 2023 include:

Enterprise Resource Planning (ERP) software

ERPs are organizational and data-storing software businesses use day-to-day to manage customer, inventory, and employee data as well as daily business functions. Some popular ERP software amongst distributors are:

Customer Resource Management (CRM) software

CRMs platforms are tools for managing a company’s data and relationships with customers. CRM tools help with contact management, sales management, agent productivity, and more. Using a CRM optimizes organization and productivity for distributors as they expand and scale their businesses. Popular CRM tools that are commonly used include:

Get More Orders

With one inbox for all orders, Prokeep enables inside and counter teams to deliver faster service, unlocking 2X more orders so you don’t lose your best customers, and reps can always be the first one to respond. With targeted marketing and branch outreach, Prokeep delivers 3X more proactive outreach, resulting in 30% more orders from your inactive customers.

How does Prokeep help distributors win more orders?

Prokeep's Order Engine is purpose-built for distribution's front-of-house; enabling counter and inside teams to take more orders from any customer channel, and marketing and branch teams to get more orders through targeted outreach. Here's how:

Distributors all over North America are using Prokeep to optimize their efficiency and create the experience modern customers need. As we move through 2023 and distributors are faced with more challenges than ever, Prokeep offers distributors a solution by better connecting their teams to their customers.

Are you looking to get the most out of your communication with contractors? book a demo today!

.png)

.png)